This is another in a series of posts on standard business plan financials, continuing from last week.

“Think of it as your business dashboard, providing a snapshot of the financial health of your company at a specific moment in time. The purpose is simple: balance sheets list assets, liabilities and owner equity, typically in order from shortest- to longest-term assets and liabilities divided on either side of the balance sheet.”

The Balance Sheet includes spending and income that isn’t in the Profit and Loss. For example, the money you spend to repay a loan or buy new assets doesn’t show up in the Profit and Loss. And the money you take in as a new loan or a new investment doesn’t show up in the Profit and Loss either. The money you are waiting to receive from customers’ outstanding invoices shows up in the Balance Sheet, not the Profit and Loss. The Balance Sheet shows many reasons why profits are not cash, and why cash flow isn’t intuitive. It’s all related to the essential principles of cash flow.

The Balance Sheet shows your financial picture – assets, liabilities, and capital – at some specific moment. It helps to understand that the Profit and Loss shows financial performance over a length of time, like a month, quarter, or year. The Balance, in contrast, is a moment. Usually it’s the end of the month, quarter, or year. Sometimes it’s the end of the business day.

Balancing is a common term associated with bookkeeping, accounting, and finance. We “balance the books.” It’s a lot like reconciling a checkbook: if it isn’t right down to the last penny, then it’s wrong. Assets have to equal liabilities plus capital. Always.

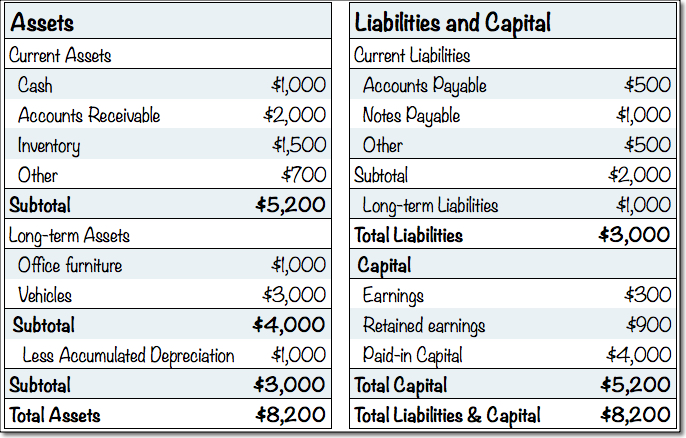

A traditional Balance Sheet statement shows assets on the left side and liabilities and capital on the right side or the bottom, as in this illustration:

The balance sheet involves the other three of the six key financial terms (the ones that aren’t on the Profit and Loss: Assets, Liabilities, and Capital).

- Assets. Cash, accounts receivable, inventory, land, buildings, vehicles, furniture, and other things the company owns. Assets can usually be sold to somebody else. One definition is “anything with monetary value that a business owns.”

- Liabilities. Debts, notes payable, accounts payable, amounts of money owed to be paid back.

- Capital (also called equity). Ownership, stock, investment, retained earnings. Actually there’s an iron-clad and never-broken rule of accounting: Assets = Liabilities + Capital. That means you can subtract liabilities from assets to calculate capital.

Although traditional printed balance sheet statements are usually arranged horizontally, as in the illustration above, balance sheets in financial projections are usually arranged vertically, showing the assets first, then the liabilities, and then the capital. Here, for example, is the balance sheet for the first few months of the bike store I mentioned earlier. It’s the balance sheet associated with the Profit and Loss for the same company, Garrett’s bicycle store:

This is planning, not accounting. It’s one of the primary principles of the lean business planning. To make a powerful and useful cash flow projection, you need to summarize and aggregate the rows of the balance sheet. Resist the temptation to break it down into detail the way you would with a tax report after the fact. This is a tool to help you forecast your cash.

The Link Between Balance and Profit

The balance sheet is so different from the Profit and Loss that there is only one direct link between the two, a vital one that connects them so that when the books are right, the balance balances: That is the direct line from profits (Net Profits) on the Profit and Loss to Earnings and Retained Earnings on the Balance Sheet. The illustration here shows the link with the bicycle store sample:

Comments

[…] Balance Sheet that shows your current assets and […]

How can I make a well representable business plan. Which I can be able to look for funding

Darren, that’s what bplans.com is all about. Start here: Business Plan Guide

When creating a business plan, is it important to show a 3 year balance sheet?

Craig, depends on context. Is it for investors? For your own use? For a lean plan, cash flow may be enough, but it’s hard to do cash flow without a summarized balance. If you want a full formal business plan, a summarized balance sheet is part of what we’d call full financials. But of course it depends on the specific context of the plan. Tim

how can i draw a balance sheet for my business plan..since the no activity has started

@Brenda. As soon as you have either capital, assets, or liabilities assigned to your business, you have a balance sheet. Correct double-entry bookkeeping will ensure that the sum of your capital and liabilities are equal to your total assets. For projections, looking ahead, you estimate ahead-of-time what you think will need to happen with your capital, liabilities, and assets. Obviously these are estimated guesses. Then as your business launches, you regularly compare actual results to what you had expected, which helps you manage.