Most of my series on standard business plan financials is generic, meaning that it is about concepts, not business planning software. Of course I’m biased about business plan software, because I believe in LivePlan as the best available solution. I try to keep that out of most of my posts. However, when we look seriously at business plan cash flow, I honestly have to recommend LivePlan. It does mathematically and financially correct calculations in the background, so that your essential business projections are as accurate as your assumptions. That takes some additional assumptions for cash flow, which you do with LivePlan guided input, as shown below in this post.

LivePlan Cash Flow Assumptions

Setting Starting Balances

For existing companies, LivePlan uses simple settings of starting balances to make calculations and estimate payments and expenses and financial flows. The simple input is shown in the illustration here:

The Vital Cash Flow Metrics

Sales on Credit, Collection Days, Payables, and Payment Days

With LivePlan’s business plan cash flow assumptions function you can change critical cash flow assumptions and watch the impact on your projections as you do. Increase your estimated sales on credit, and you decrease your estimated cash balance. Increase the days you wait to get paid, and you decrease your cash balance. And with payments, increase your purchases on credit, and you increase your cash balance. Increase the days you wait to pay, and, there too, you increase your cash balance (and make your vendors unhappy, and possibly hurt your credit rating, but that’s for a different discussion).

Remember please that these are simple assumptions. Don’t sweat the details. You may be tempted to try to divide your receivables flow into categories of customers, or make allowances for special customers, but on the long term that doesn’t work well. This is planning, not accounting. Don’t expect your estimates to be exactly right for every month, and remember the goal is to set assumptions you can track during your monthly review and revision session.

If you have no idea, go back to fundamentals. Sales on credit are the rule with business-to-business sales, so if you sell to businesses, play it safe and put 100% sales on credit. If you sell to a mix of business and consumers, or you sell to some consumers on credit, then think it through. One easy way to estimate, if you have some past history, is to divide your average balance of Accounts Receivable for the last year by your average total monthly sales for the year, and use that percentage as a guide.

For collection days, you can calculate your average collection days from past results by using a simple formula (thanks to investopedia.com):

If you’re not sure, or you have no past results to go on, estimate 60 days unless you are in a particularly slow paying area of industry (you should know), in which case you should estimate 90 days.

Dealing with Inventory

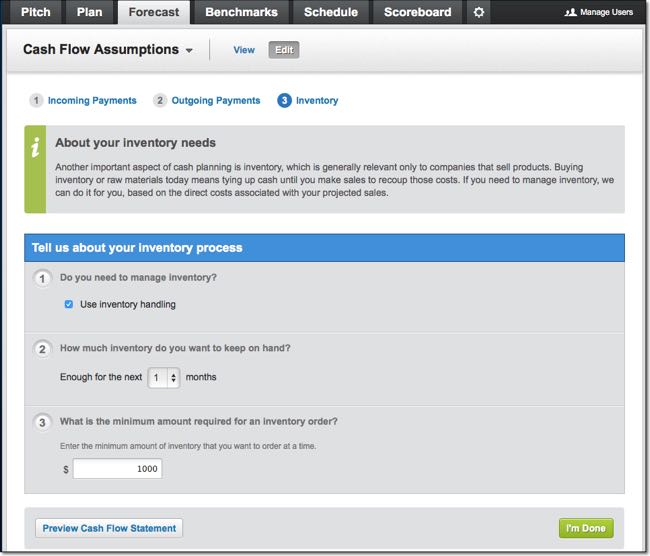

You might notice in the illustration above the switch at the bottom of the LivePlan cash assumptions, for inventory. Service companies don’t typically have to manage inventory, so this is a switch that is either on (for product businesses) or off (for service businesses). When switched on, it gives you two additional assumptions needed to add the impact of buying and managing inventory into the projected cash flow.

LivePlan Cash Flow

LivePlan automatically takes your assumptions for sales, spending, and the three critical cash flow assumptions for sales on credit, payments, and inventory; and gives you month-by-month estimated cash flow. The result is in the illustration here:

Obviously cash is vital to business, and cash flow is vital, so this is a critical component of every lean business plan.

LivePlan Reality Check

Just as it did with the Gross Margin for the sales forecast direct expenses, the LivePlan Benchmarks view also helps you compare your cash assumptions to industry standards:

Cash Flow Takes Constant Attention

Don’t think the cash flow comes out fine the first time you do your LivePlan projections. More often than not, and especially with startups, after the first round of assumptions, the estimated cash balance is negative.

That’s really important information. It tells you that you need to plan for working capital. If your projected cash balance is negative, then you’re not done with your projections. Welcome to the real world. You can’t have a negative cash balance. The spreadsheets don’t care, but the bank will, and your payees will, because your checks will be bouncing. So you have some classic options to deal with:

- Go back to your projections and figure out how to sell more or spend less; or

- invest more money as capital: yours, or some other investor’s; or

- borrow money to make up the difference.

With LivePlan, as you decide how to handle your working capital problems, you go back into your assumptions and revise them. Use the Loans and Investment feature to add money from either source. Use the sales forecast and spending budget to estimate how you will increase sales or cut spending.

Remember, though, that there is no use for unrealistic assumptions. Make it happen in the real world, not just in the plan. Lean business planning is about running your business better, not just managing projections to look good.

Comments